How to Claim Automobile Depreciation After a Car Accident

“Most insurance carriers do not automatically compensate for automobile depreciation. That is why you must understand the conditions guiding an insurance policy before signing an agreement.”

Car accidents can cause immense damage, ranging from bodily injuries to automobile depreciation. Once your car gets involved in an accident, the value of the car depreciates. Accidents can even make your car value decrease below the common depreciation rules for vehicles. Generally, you will have to file a claim concerning automobile depreciation separate from the claim for the cost of the repair to your car. Such claims are known as diminished value claims.

As car accidents are incredibly common effects, filing a claim serves as a means of compensation. Normally, filing for diminished value claims is often carried out by drivers that are not at fault for the accident. To know how to claim automobile depreciation after an accident, you must know the kinds of diminished value claims that you can file.

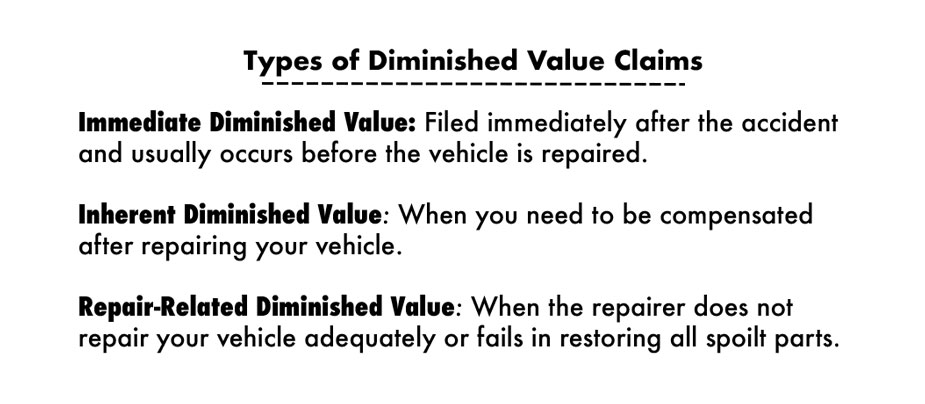

Types of Diminished Value Claims

There are various kinds of diminished value claims depending on when you file it:

- Immediate diminished value: Diminished value immediately following the accident: This is the kind of diminished value claim where you can make immediately following the accident. The problem usually occurs before the vehicle is repaired.

- Inherent diminished value: This is the concept of inherent diminished value, which occurs when you need to be compensated for the loss of value of your vehicle after having it repaired.

- Repair-related diminished value: It is only in these types of claims that you can claim a reduced value as a result of repairs that the mechanic has performed insufficiently or has failed to restore all of your vehicle’s parts.

The inherent diminished value claim is the most popular of all three. In a situation where your insurer does compensate you for the loss of value for your vehicle, you can move to file a diminished value claim with the insurance company. However, most insurance carriers do not automatically compensate for automobile depreciation. That is why you must understand the conditions guiding an insurance policy before signing an agreement.

When you need compensation as a result of incomplete repairs, you will have to file a diminished value claim. Most states rely on the immediate diminished value to measure automobile depreciation. In that case, the insurance company may be responsible for the compensation.

How to File a Claim for Automobile Depreciation

Filing a diminished value claim requires supporting information to back up your claims. First of all, you have to research the value of your automobile before the accident. You can then compare it with the depreciated value, which sometimes goes lower than the first year auto depreciation.

In order to conclusively establish this, you can get an opinion from a dealer about the value of your car now relative to before the accident. Once you have all the information you need, you have to reach out to the insurer of the driver that is at fault.

As a complainant, you must inform the insurance company of the accident and tell them about the claim and provide supporting evidence regarding the value. Remember, the burden is on the complainant to prove the value of the case. You must compare the amount they are offering to your own proposed compensation plan.

Moving Forward

“Once you have agreed to accept a settlement and signed a release from the insurance company, it is unlikely that you will be able to return for additional funds in the future.”

In a situation where you don’t accept the terms of their offer, you have limited options–filing a lawsuit for the diminished value of the vehicle or attempting to resolve it outside of court with the state insurance regulatory board. They are not necessarily mutually exclusive actions.

Laws Affecting Automobile Depreciation Claims

Various states have different laws affecting automobile depreciation claims. Most states expect that after an accident, the driver that is not at fault can file a claim for automobile depreciation. State laws vary based on who gets to file the claim, calculations of the automobile depreciation, the car depreciation limit, time frame for filing a claim, and the form and amount of the financial compensation.

Pursuant to Arizona state law, diminished value is calculated by figuring out the fair market value at the time immediately before the accident and the current market value of the car. Whatever the difference is between those numbers is the value of the claim.

Alongside Arizona, other states that allow the driver to receive compensation from the insurer of the at-fault driver include Colorado, Florida, Georgia, Illinois, Indiana, Iowa, Kansas, Louisiana, Maryland, New Mexico, New York, Oregon, South Carolina, and Virginia.

How Goodnow McKay Can Help

Having experience and expertise in handling all types of auto claims, Goodnow McKay is here to assist you in this tough situation. Providing our clients with fair compensation is at the core of what we do.

If you are looking for a free consultation to help you get the settlement you deserve, then contact us today.